ATTENTION: TARGET AUDIENCE

Maximize Your Refund with Expert Tax Advice

When you choose our tax preparation services, you gain access to a team of experienced tax professionals dedicated to optimizing your refund. We'll work closely with you to uncover every eligible deduction and credit, ensuring you keep more of your hard-earned money.

WHAT WE OFFER

Our journey began with a simple goal: to empower our clients with the knowledge and support they need to achieve their financial dreams. Over the years, we've honed our expertise, staying at the forefront of ever-changing tax regulations, and adapting to the evolving needs of our diverse clientele.

our services

Tax Resolution Services

Promote services that help clients resolve tax-related issues with the IRS or state tax authorities. Explain how you assist with offers in compromise, penalty abatement, installment agreements, and innocent spouse relief, among others.

International Tax Services

Highlight your expertise in international tax matters. Describe how you assist clients with foreign income reporting, tax treaties, expatriate tax, and foreign bank account reporting (FBAR). Mention any specialized knowledge of cross-border tax situations.

International Tax Services

Highlight your expertise in international tax matters. Describe how you assist clients with foreign income reporting, tax treaties, expatriate tax, and foreign bank account reporting (FBAR). Mention any specialized knowledge of cross-border tax situations.

Estate and Inheritance Tax Planning

Emphasize your estate and inheritance tax planning services. Explain how you help clients navigate complex tax implications associated with wealth transfer, inheritance, and estate planning. Provide information on strategies to minimize tax liabilities for beneficiaries.

Nonprofit and Tax-Exempt Organizations

Showcase your services for nonprofit organizations seeking tax-exempt status or compliance with tax regulations. Describe how you assist with nonprofit formation, filing for tax-exempt status, and annual reporting requirements.

Nonprofit and Tax-Exempt Organizations

Showcase your services for nonprofit organizations seeking tax-exempt status or compliance with tax regulations. Describe how you assist with nonprofit formation, filing for tax-exempt status, and annual reporting requirements.

My Clients

Feedback from our delighted clientele.

"Loved everything so far"

"Testimonial lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim dolor elit."

- Your Name

"My life changed forever"

"Testimonial lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim dolor elit."

- Your Name

"Highly recommend this"

"Testimonial lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim dolor elit."

- Your Name

STILL NOT SURE?

Frequently Asked Questions

We understand lorem ipsum dolor sit amet, consectetur adipisicing elit.

How can I file my taxes with Capitol Taxes?

Filing your taxes with Capitol Taxes is easy and convenient. Simply visit our website and create an account if you haven't already. From there, you can access our user-friendly online platform, where you'll be guided through the tax filing process step by step. Our platform is designed to make it as straightforward as possible, and if you ever have questions or need assistance, our expert team is just a message or a phone call away. We're here to support you throughout the entire process.

What sets Capitol Taxes apart from other tax preparation services?

What distinguishes Capitol Taxes is our dedication to personalized service and expertise. We understand that every taxpayer's situation is unique, and we tailor our services to meet your specific needs. Our team of experienced tax professionals is well-versed in complex tax scenarios, and we stay updated on the latest tax regulations. We also offer year-round support, ensuring you have access to expert advice beyond tax season. Our transparent pricing and commitment to client satisfaction are the cornerstones of our service, making us a trusted partner for all your tax needs.

Is my personal and financial information secure with Capitol Taxes?

Yes, your security is our top priority. At Capitol Taxes, we employ state-of-the-art security measures to safeguard your personal and financial information. Our online platform is encrypted to protect your data from unauthorized access, and we adhere to strict confidentiality standards. Rest assured that your sensitive information is handled with the utmost care and is never shared with third parties. Your privacy and security are paramount to us, and we take every precaution to maintain the trust you place in our services.

Meet the Team of Professionals

Jerome Jnofinn

Founder & Chief Executive Officer (CEO)

Erik Bustos

Senior Tax Preparer

Kim Lloyd

Communications Coordinator

Imelda Torres

Associate Tax Preparer

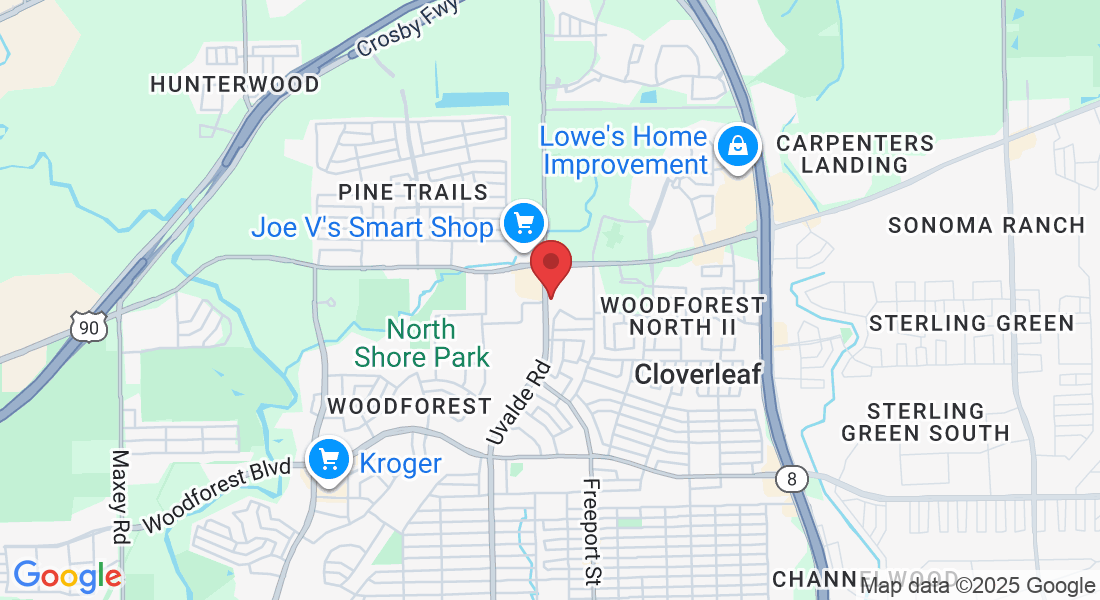

Our success is built on the dedication and professionalism of the individuals who make up our team. As a locally trusted office serving the community for more than 15 years, we take pride in offering dependable, personalized support to every client who walks through our doors.

We are a diverse team led by a U.S. veteran, reflecting the culture of the neighborhood we proudly serve. Our staff represents multiple backgrounds, and our office is fully fluent in both English and Spanish, ensuring clear communication and an inclusive environment for all clients.

With extensive experience in tax preparation, real estate services, notary support, and a variety of additional offerings, our team brings a strong commitment to accuracy, integrity, and exceptional customer care. We remain dedicated to ongoing learning and staying current with industry changes so that we can continue providing you with reliable guidance year-round

Copyrights 2025 |Capitol Taxes™ | Terms & Conditions